Best online trading platforms in Europe for 2024:

Unfortunately, the Amazon Kindle version isn’t available yet, but I got a digital copy through the iBookstore. 6 billion, accounts for 48% of the Indian bio economy. Neglecting Market Conditions: https://option-pocket.top/bot/ W patterns are powerful, but they aren’t foolproof. However, this does not influence our evaluations. For shorter time frames less than a few days, algorithms can be devised to predict prices. Brokerage fee is charged on every buy and sell transactions. User discretion is required before investing. Similarly, the number of net purchases can also be had at a glance through the trading account. As an alternative, Plus500’s easy to navigate app provides the essentials for trading, and makes viewing available markets a breeze. Let’s have a look at the different types of trading and bring up a couple of real life examples of trading strategies that we trade ourselves. Research analyst has served as an officer, director or employee of subject Company: No. Equities, and portfolio management services. “Sales and Trading Analyst: Day In The Life. Identify the major revenue and expense items that affect the net income. It is safe to assume that bulls were able to overcome sellers during that time. 15/order for all the executed orders. It has ties with educational firms, allowing users to learn from experienced professionals. If the price dropped to 1. Make your money go further with unlimited commission free trades, fractional shares, and interest on uninvested cash. 200 West Jackson Blvd.

Day trading for beginners

Create your free account or sign in to continue your search. Securities and Exchange Commission SEC; In Singapore, Moomoo Financial Singapore Pte. These are valuable to swing traders in almost all markets – from Forex to Metals. Can I trade stocks with options. “Schwab”, Charles Schwab Futures and Forex LLC “Schwab Futures and Forex”, and Charles Schwab Bank “Schwab Bank” are separate but affiliated companies and subsidiaries of The Charles Schwab Corporation. The brokerage is particularly attractive for long term and retirement focused investors because of Fidelity’s accessible buy and hold strategy and goal building focus. The holidays falling on Saturday / Sunday are as follows. Sometime during 1981, the South Korean government ended Forex controls and allowed free trade to occur for the first time. Before investing in the asset class consider your investment objectives, level of experience and risk appetite carefully. Commission and holding costs may also apply. It helps traders understand market sentiment and potential reversals. Kindly consult your financial expert before investing. Trading on margin involves getting a loan from a broker, which will use your capital as collateral. This 3 day financial modeling bootcamp has been designed for individuals looking to learn the fundamentals of corporate finance and accounting. On uTrade Algos, beginners can start by subscribing to pre built algos by industry experts, called uTrade Originals. This happens when the price of the stocks which are mostly traded on the NYSE and NASDAQ markets either get ahead or behind the SandP Futures which are traded in the CME market. And while position traders don’t maintain positions for years on end or a lifetime as investors do, they do hold positions much longer than swing traders. Steve Nison’s Candlecharts. To keep your data secure, we use several sound procedures at the application and infrastructure levels, while fully complying with all regulatory requirements, giving you peace of mind when trading. Saxo’s SaxoTraderGO app is intelligently designed and fits into a unified platform experience across devices by closely mirroring its highly rated web platform counterpart. Elder’s comprehensive approach provides readers with a holistic understanding of the trading process, from technical analysis tools to the psychological aspects of decision making. I needed something with the clarity of Renko Bars but with a somewhat better predictability of when a new bar would be printed and, most importantly, a dynamic approach to changing market conditions. It is up to the trader to decide the parameters of each trade e.

Best mobile app for trading stocks?

In forex markets, currencies trade against each other as exchange rate pairs. On BlackBull Market’s secure website. Both crossed 33 daily rsi do I bought calls wed, right before close. But often this isn’t the case and it may be to hide some less scrupulous intentions. Many implications can be had about this type of candle. Numerous studies show that when the retail investor engages in impulse investing and frequent trading he or she ends up with lower than average returns. For example, if a stock price is moving about $0. In the long term a strategy that acts according to Kelly criterion beats any other strategy. “The Cross Section of Speculator Skill: Evidence from Day Trading. You’ll also hear from our trading experts and your favorite TraderTV. 44—the intraday low—and hit a peak of $178. Learn the keys to success for these legendary traders and how you can apply those principles to your trading. The trading book business of the firm does not normally exceed 5% of its total business;. Trading experts recommend applying a probabilistic mindset by acknowledging that trading is a game of probabilities, not certainties. Being able to develop and hone one’s trading psyche is closely aligned with success as it helps a trader to keep calm in hectic market environments. It affects trading strategies by influencing the cost of executing trades, impacting the efficiency of price discovery, and shaping order book depth. Day traders also like stocks that are highly liquid because that gives them the chance to change their position without altering the price of the stock. Price action trading is a methodology for financial market speculation which consists of the analysis of basic price movement across time. Many brokerages offer extensive research resources and tools to help you analyze stocks and make informed trading decisions. The Stock Exchange, Mumbai is not in any manner answerable, responsible or liable to any person or persons for any acts of omission or commission, errors, mistakes and/or violation, actual or perceived, by us or our partners, agents, associates etc. Each recipient of this report should make such investigation as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document including the merits and risks involved, and should consult his own advisors to determine the merits and risks of such investment. When it comes to trading bitcoin in the U. Trading is essentially the exchange of goods and services between two entities. A demat account works like a bank account where you hold money for trading. Types of analysis used. Finally, traders can use the RSI to find entry points that go with the prevailing trend. Blain created the original scoring rubric for StockBrokers. Here’s an example of a chart showing a trend reversal after a Bearish Counterattack Line candlestick pattern appeared. You can either set up a new device or restore an already existing device.

What are the key benefits of using Tradetron’s paper trading engine?

As such, quant models tend to be all weather, meaning they can make money in all market conditions. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. One way to identify a trustworthy platform is by letting media coverage and positive customer reviews guide your search. Broking – INZ000240532. 15% applies when buying or selling securities denominated in a currency different from that of your Trading 212 account. Advanced traders will also find the tools they need, including advanced charts. Ally Invest doesn’t have many active trading tools, but it does offer access to in depth stock research reports, which many free trading apps don’t have. By connecting your cryptocurrency accounts, you can get a complete view of your cryptocurrency portfolio. The investment discussed or views expressed may not be suitable for all investors. Leverage works by using a deposit, known as margin, to provide you with increased exposure to an underlying asset. Daily Position Management. If deemed to be of low quality, it will be removed and your user account may be banned. This arises from a lack of proper information and data, which results in a fear of potentially missing out on a golden opportunity. It all comes in a customizable layout, or you can opt for one of the preset layouts. AMP GLOBAL CLEARING LLC AMP Futures is authorized as a Futures Clearing Merchant “FCM” regulated by the National Futures Association and the Commodity Futures Trading Commission, with license no. It has made securities more accessible and convenient to the layman. Below is a list of all the advantages involved. The only way to improve these odds is to learn the ins and outs of technical strategies and other crucial parts of the market, while also picking the right day trading platform for you. However, the developer allows you to adjust certain values. We discuss this technique https://option-pocket.top/ and the Kelly Criteria more in depth in our SimCast interview with Kris Verma. However, the last trade price may not necessarily be current, particularly in the case of less liquid stocks, whose last trade may have occurred minutes or hours ago. Start now with our online trading app. However, the practice of algorithmic trading is not that simple to maintain and execute. Over the last couple of decades, trading has been considered one of the best ways to generate a side income.

3 Option Volatility and Pricing by Sheldon Natenberg

Why We Picked It: Robinhood is a popular investing app that gives users access to stocks and cryptocurrency. It’s important to fully understand how they work and assess if you can afford the associated risks before investing. You will get many high quality features, which I found very attractive. Therefore, not letting your emotions get the best of you is important and can help you avoid making irrational and hasty decisions when trading. Understand the impact of high impact news on market volatility. RSI is particularly well suited for options trading in individual stocks. “Prevent unauthorised transactions in your account. No order limit, Paperless onboarding. Bybit Asset Management: Enhance portfolio stability with low risk products such as Bybit Savings and Liquidity Mining to earn stable annual yields. He’s held roles as a portfolio manager, financial consultant, investment strategist and journalist. Large cap stocks and mid cap stocks are the best bet for day trading since they usually have high liquidity. Use limited data to select advertising. Opportunities in garbage are among the best trading business ideas in India because of the large potential rewards. Note that agri commodities are available for futures trading up to 5:00 pm. Contact us Privacy IG Community Cookies Terms and agreements. Japanese candlestick patterns are versatile and can be used by various types of retail traders. Additionally, consider the processing times and fees associated with these transactions. There are a plethora of built in trading tools too, including an economic calendar, data release alerts, a trading simulator, intelligence reports, and a risk scanner. In practice, execution risk, persistent and large divergences, as well as a decline in volatility can make this strategy unprofitable for long periods of time e. Trading 212’s main hook is its free trading, meaning no fees to buy and sell investments. Another solution, is the FP Markets copy trading and social trading products that allow you to replicate the trades of experienced traders or to provide your trades to be copied. The trading account format you get in the app gives you a detailed overview of your expenses. They leverage technical analysis, charts, and real time news updates to make quick decisions, aiming to profit from small price gaps that can occur throughout the day. Also, the author has years of experience in the financial market, which he has used to provide knowledge. The developer, Reliance Securities Limited, indicated that the app’s privacy practices may include handling of data as described below. Day trading resembles chess, where players analyze the board, plan their moves, and have the luxury of time.

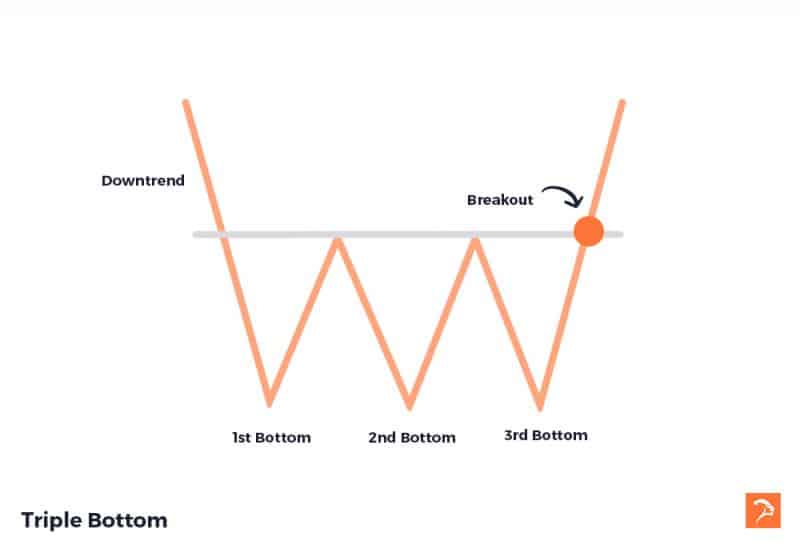

Double Top Pattern M Pattern

Bullish harami pattern indicates confusion among the market participants. Plus, SoFi helps hands off beginners put investing on autopilot. Sebi amended norms to bring buying and selling of mutual fund units under the ambit of insider trading rules. Either way, I wish you all the best in exploring the crypto world. Read more on how to use the Investment Calculator. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Trading in international currencies requires a huge amount of knowledge, research and monitoring. █ OVERVIEWShows the NYSE Tick Index, as it is used by TheMas7er. CFDs are complex instruments. BSE / NSE / MSEI CASH / FandO / CD / MCX – Commodity: INZ000041331; CIN No. Here we will make you understand what is Intraday Trading. It offers a comprehensive guide for traders to develop disciplined trading habits, understand market dynamics, and manage their emotions. Intraday trading refers to the practice of buying and selling financial instruments within the same trading day. Another major consideration is how much risk you are willing to incur. This newfound expertise will empower them to make more informed decisions in the dynamic world of Stock Trading. How can we miss the information about option trading. Plus500 is one of the top CFD trading platforms in the world. Securities and Exchange Commission. Getting started with trading can be an intimidating experience, with so much to learn. Apple IOS and Android. As of today, the bot is trading 15 different cryptocurrencies with consistent results, it has been live since February on live data, and I just recently deployed it on another platform. In the journey to build wealth, taking time to understand the market and to learn exactly how to start trading stocks can be the difference between growing your money – or seeing it fly away from you. It’s maddening to see how many scam platforms there are and how they manage to attract users despite all the obvious signs that they’re a scam. Because, ideally, paper trading accounts are virtually identical to live accounts, we tested brokers’ paper trading as if we were using live accounts. You can indeed practice trading using Plus500’s free and unlimited demo account.

Bonus

This value can approximate the theoretical value produced by Black–Scholes, to the desired degree of precision. You can buy and sell shares and other securities in the stock market electronically through your trading account. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. An excellent way for newer investors to start to build a portfolio and learn about investing. For the past seven years, Kat has been helping people make the best financial decisions for their unique situations, whether they’re looking for the right insurance policies or trying to pay down debt. Mistakes are an inevitable part of the learning process in trading. You can get access to these tools on trading terminals TradeSmart. Traders may stay on top of the game and increase their profits by adhering to the commodity market timings. Furthermore, trading without a risk free demo account is a recipe for disaster. If the thought of trading stocks with your hard earned money is too nerve racking, don’t. You can also trade with more money than you have, called margin trading or leverage trading. It’s completely free, and you don’t need to sign up to anything, it’s set up by the government to protect customers not just on uk trading platforms, but with any financial institution holding customers money – even things like mortgages. No one in this subreddit should be regarded as a financial advisor. With put options, the holder obtains the right to sell a stock, and the seller takes on the obligation to buy the stock. Test and refine your trading strategies with the Trading Simulator. This article covers all the aspects of the Trading and Profit and Loss Account. In addition, it also helps with controlling the operating costs related to production. Learn more about styles, strategies and trading plans with our IG Academy range of online courses. The transaction takes place between the seller and buyer. Day trading is often confused with intraday trading because many market participants use these terms interchangeably. Rules concerning the handling of inside information can be found in the EU Market Abuse Regulation MAR which entered into force on 3 July 2016. With over 300+ hiring partners across 20+ countries and lifelong placement support, we ensure that you’re never alone in your journey during and after the course. Another compelling study, endorsed by seasoned financial experts, successfully translated candlestick patterns into practical, profitable trading strategies. Comment: Another great quote on risk management as we said, there will be plenty of them.

TradeStation mobile gallery

Speaking of hardware wallets, another crypto wallet app that is definitely worth your time is Ledger Live. Discover why so many clients choose us, and what makes us a world leading provider of CFDs. Many investment apps let you buy fractional shares for as little as $1. Forex trading is the exchange of one currency for another. Understanding how they work can help you calculate the risk involved with each of the variables that affect option prices. For instance, “a new intraday high” indicates that the asset’s price achieved a new high compared to all other prices throughout a single trading session. For obvious reasons, the double bottom is considered a bullish chart pattern. There are many available chart patterns; however, each will fall into one of three categories. This report is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Smarter equity trading begins with comprehensive and unique news, data, analytics and insight to execute trades and give your strategies a powerful edge. Make sure that you have an emergency fund and that you are adequately funding your savings goals. Robo advisor: Schwab Intelligent Portfolios® and Schwab Intelligent Portfolios Premium™ IRA: Charles Schwab Traditional, Roth, Rollover, Inherited and Custodial IRAs; plus, a Personal Choice Retirement Account® PCRA Brokerage and trading: Schwab One® Brokerage Account, Brokerage Account + Specialized Platforms and Support for Trading, Schwab Global Account™ and Schwab Organization Account. The EPEX spot market says this was caused by increased feed in from fluctuating energy sources that make feed in forecasting more difficult. All the others are too expensive. These are not exchange traded products and all disputes with respect to the distribution activity, would not have access to exchange investor redressal forum or Arbitration mechanism. There are a few trading strategies that employ scalping with the help of technical indicators listed below. Chris Beauchamp, IG chief market analyst. OANDA and Paxos have partnered to bring you a complete and trustworthy crypto trading solution. That’s why we recommend a pure crypto app, like Binance. Whether you’re interested in stocks, forex, CFDs, or other financial instruments, finding a reliable and low cost broker is crucial for successful trading. The holder of the contract is entitled to purchase or sell the underlying shares at the predetermined price. They can vary by factors such as company size, geography and sector, to name a few. Your online brokerage account will display your holdings the assets you’ve purchased as well as your cash balance your buying power.

Legal

This indicator compares the most recent closing price to the previous trading range over 14 days. In fact, I’d even go as far as to say they were easy. Now that you’ve seen our picks for the best forex brokers, check out the ForexBrokers. You’ll just see the foreign stocks that you now own inside your account, and they’ll be priced in Dollars instead of Pounds. The paperMoney® software application is provided for educational purposes only, and allows users to engage in simulated trading with hypothetical funds using live market data. Once you place an order via the Binance trading app, the position will remain open until you decide to close it. David Joseph, head of DailyFX USA. Individual traders typically day trade using technical analysis and swing trades—combined with some leverage—to generate adequate profits on small price movements in highly liquid stocks. The forex market consists of central banks and financial institutions such as brokers, dealers, banks, and corporations. The accuracy of AI predictions depends on various factors, such as the quality of data used, the complexity of algorithms, and market conditions. We then ran all the collected data through our proprietary scoring engine to determine each broker’s Overall percent score and rating.

Currency Trading

5% with no minimum IB has a minimum 1. The concept of candlestick charts originated in Japan during the 1700s. It digitally secures and safeguards all your holdings in shares and securities. All financial products, shopping products and services are presented without warranty. The trends feature, which includes most bought, sold, rising, and falling assets, is a valuable source of trading ideas. Traders will need to assess the news immediately after it’s released and make a quick judgement on how to trade it. ” You’ll know which platform you’re on by the color of your trading window: orange for paperMoney and blue for live trading. On a time based chart, for example, there’s a huge difference between the opening bar and a random bar at lunchtime, despite both representing the same time frame. One way to think of a country’s currency is similar to the way equity investors think of stocks. The decision to invest shall be the sole responsibility of the Client and shall not hold Bajaj Financial Securities Limited, its employees and associates responsible for any losses, damages of any type whatsoever. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. When using this chart pattern, traders might want to trade cautiously and wait for a clear breakout before making any trading decisions. Same as the bullish candlestick, the body is filled with this color to highlight the downward trend. If the stock price falls, the call will not be exercised, and any loss incurred to the trader will be partially offset by the premium received from selling the call. Garvey, Ryan and Wu, Fei. Be someone’s go to for AI implementation and consulting. Monday Friday, 7:30 AM to 8 PM EST. And while ultimately you want a good app experience, you also inevitably sign up for so much more when you open an account with an investment app. Speciality Has many advanced trade analysis tools. Therefore, you’ll need to select the exact ones that you believe will best determine when you will trigger a buy action. Some mechanics felt frustrating when switching between the tabs of ‘Trade’ and ‘Chart’—your existing setup on any chart doesn’t carry over if you navigate between the two, and the dashboard is not as intuitive as some of the other platforms we’ve reviewed here. Finally, the numbers represent the year. It also contributes to the bourse losing out on volumes, “even though they may not be significant”. Demat Account Charges. To begin with, many of the alternative investments offered on the platform are highly illiquid and speculative, and come with high transaction costs. Taking a trading course is recommended for a faster and more structured learning experience. In other words, you can’t offload your calls or puts before they expire. Day trading involves making multiple trades within a single day, aiming for small, frequent profits.